Statement of financial position – Example and guide

2 Sep 2020If you run a small business, you’re probably familiar with the term ‘balance sheet’. However, like ‘the Artist Formerly Known as Prince’ the balance sheet can also be known as the ‘Statement of financial position’.

The statement of financial position is an important financial document that helps you run your business efficiently and profitably. It provides a guide to the financial health of your business, so it’s essential to understand its components and their significance.

In this guide, we show an example of a Statement of financial position and we’ll explain the various elements.

The Statement shows the financial position at a specific point in time, (otherwise known as a snapshot) which is normally reported a your years-end or when management accounts are provided to stakeholders. By comparing figures for other years, you can compare performance with the previous year and highlight any risks or opportunities.

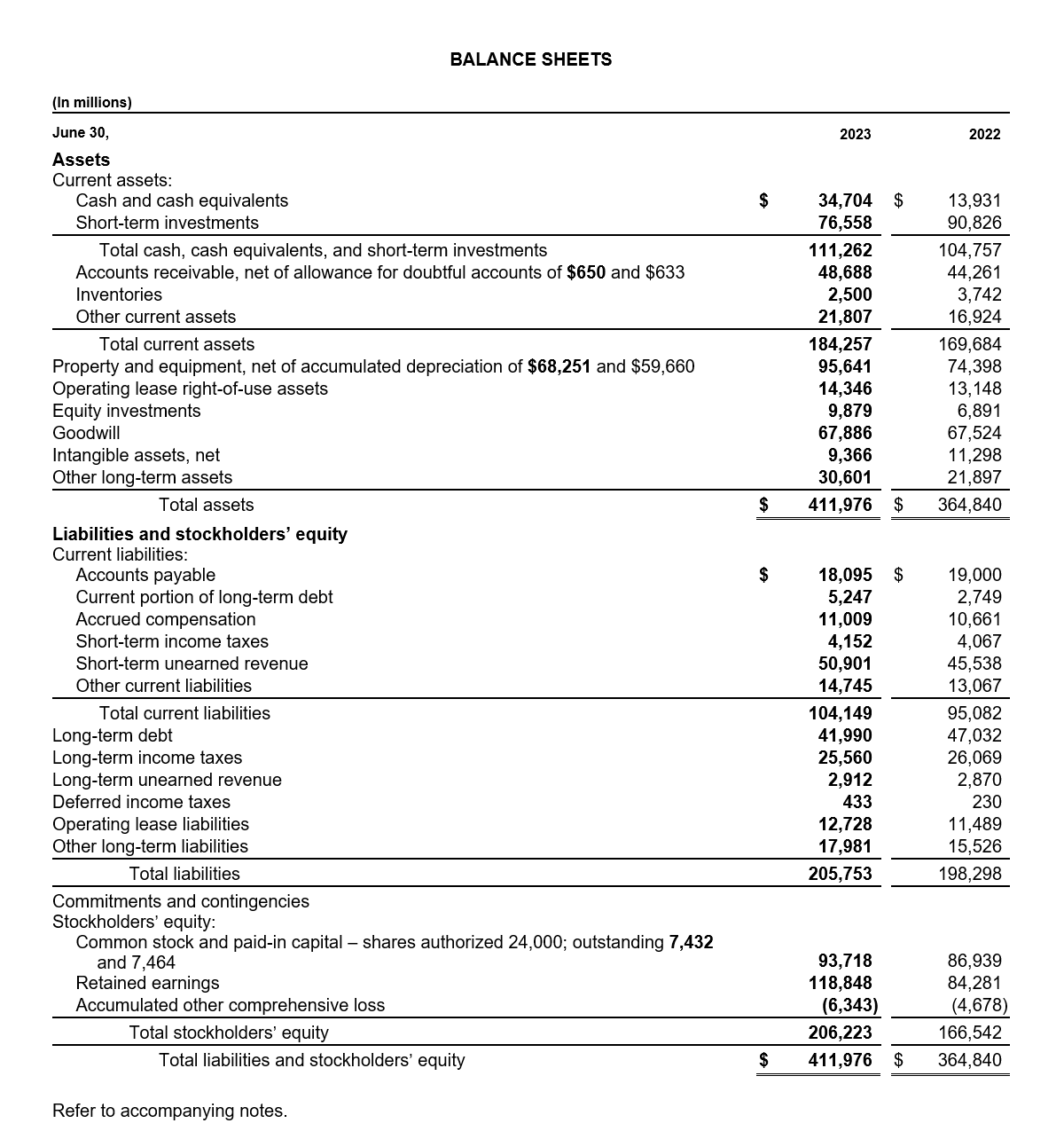

Statement of financial position example

Here is Microsofts 2023 statement of financial position as an example. Notice how it is compared to the previous year, so see if the company is growing, shrinking or staying the same.

Read More: Everything you need to know about Creditors and Debtors

Statement of financial position breakdown

The example of a Statement of financial position includes a number of important terms.

Fixed assets

These are assets that you own and keep for a longer period to run your business, rather than items for sale. Typically, they would include property, vehicles, machinery and equipment. You put a value on these, which would have originally been based on the price you paid for the asset.

Intangible assets

You may also have intangible assets which are assets you can physically hold or see. Some examples of intangible assets include the value of patents, licenses, trademarks or copyrights that your business owns.

Depreciation

Depreciation lowers the value of those assets over time. HMRC allows you to depreciate different types of asset by a specific percentage each financial year.

Total fixed assets

This is the current value of your fixed assets after you have deducted depreciation.

Current assets

These are assets that you can turn into cash in the short term. They are an indication of your liquidity.

Debtors

Debtors represent the amount of money owed by your customers at the time you compile your Statement. You could calculate this figure from invoices due for payment by the Statement date.

Cash

This is the amount of physical cash you hold. Generally, this would be petty cash you hold for settling expenses.

Bank

This figure is taken from the balance of funds in your bank accounts on the date of the Statement.

Net assets

Adding together the value of your fixed assets, current assets and minus any creditors gives you the value of all your net assets.

Current liabilities

This represents the amount of money you owe on the date of the Statement.

Creditors

This is the amount of money you owe to suppliers, based on invoices due for settlement by the date of the Statement.

Tax

This figure represents any Corporation Tax, VAT or PAYE payments due by the date of the Statement.

Loans

This is the outstanding amount of any loans or grants on the date of the Statement, including capital and interest.

Capital and reserves

This figure covers the amount of money shareholders have invested in the business.

Profit/loss

The profit or loss you made in the financial year is brought across from your profit and loss statement.

Capital at end of year

Adding together your profit or loss, capital and reserves and funds not yet paid to settle current liabilities provides you with a figure for capital at the end of the year. This figure should be the same as the value of total assets.

Related: What are statutory accounts? A short guide

Analysing a statement of financial position

Creating and reviewing your Statement of financial position is not just an accounting exercise, it is an important tool for financial management and it can help you make effective, financially sound decisions about maintaining and growing your business.

In its simplest form the Statement indicates the net worth of your business – the difference between your total assets and your current liabilities.

One important indicator is the difference between current assets and current liabilities. Do you have enough funds in terms of cash, bank deposits and customer payments due to settle your liabilities?

An imbalance here could highlight a potential cash flow issue before it becomes a major problem. You may need to look for additional working capital to deal with the problem.

Analysing current liabilities also indicates the level of debt for the business. If the level of debt is high or if it has increased significantly over the previous year, you could face serious problems in the future if your earnings are not sustainable.

The Statement can provide insight into other important business ratios and trends. For example, the section on debtors can tell you how long it takes to receive payment from customers. You may need to tighten payment terms to improve cash flow.

Analysing the Statement gives you an indication of the health of your own business. You can also use the information to compare your performance and your key ratios with other companies in your market. For example, what is the average ratio of debt in the industry and how do you compare? How much capital do similar-sized businesses employ?

Securing funding

The Statement of financial position can have a dual purpose. It can highlight the need for additional funding and help you to secure it.

Lenders and investors require evidence and reassurance of your company’s financial health and prospects to reduce risk before advancing funds. They want to see a picture of financial health over a period of time, so may wish to see several statements and they want to see that you have a good record of collecting payments and repaying debts on time.

Accounts and Legal can help

Understanding all the information on a Statement of financial position can be complicated and time-consuming. Our team of small business accountants are highly-experienced in helping firms with the preparation and analysis of these documents. Get in touch with us today for further advice on 0207 043 4000 or info@accountsandlegal.co.uk.

You can also get a free accounting quote in a few simple clicks with our online tool.