PAYE: real time reporting

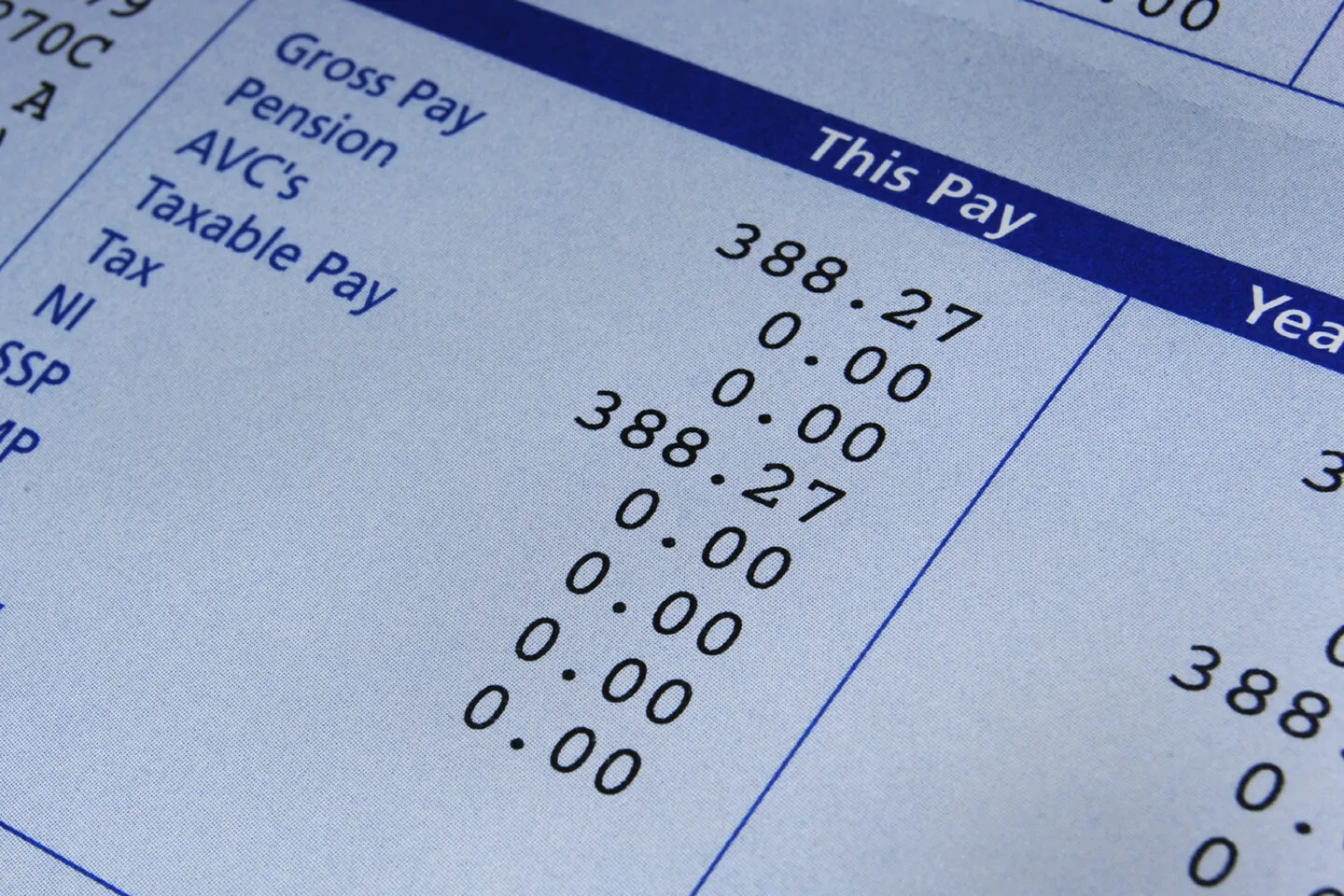

9 Apr 2013As of 6 April 2013, all business are now required to report payroll information in real time. The objective of the excercise is to make sure that fluctuations in earnings don't cause HMRC to miss out on increasingly important tax revenue and equally to ensure that employees don't overpay if their circumstances change during the tax year. An added benefit from HMRC's perspective will be to allow it to adjust benefit payments according to actual earnings.

To do this, most employers who run their own payroll, will need to make sure they are using RTI-ready software, so that this can be tagged and submitted automatically. Companies using outsourced payroll services, need to check that their provider is complying with RTI requirements (as is the case with our payroll services).

Choosing the right software will make life much easier

For business that employ nine or fewer people, it is possible to use HMRC's free Basic PAYE Tool.

The new rules, don't however change the way that tax and national insurance is calculated. However, the end-of-year P35 form no longer needs to be submitted and the infamous P45 and P46 forms that are used to start and commence employment will no longer be required as this information will be provided as part of your regular Full Payment Submission (FPS). The P60 (the summary of employees' pay and the tax that's been deducted from it in the tax year), still need to be prepared and distributed to employees.

If this sounds like a headache you could do without, the good news is that we are here to help. Drop us a line and we'll be more than happy to talk you through it and recommend software or take on your payroll production processes as required.

By the way, if you haven't had a quote from an accountant recently, why not drop in to our London head office or try our Instant Accounting Quote?