What is Xero Cloud Accounting?

12 Aug 2020If you run a small business, you’ll know how time consuming it can be to manage your accounts efficiently and ensure access to the latest financial information. Complex manual processes, out-of-date figures and restricted access for important stakeholders are all familiar problems. Fortunately, there is a solution that is designed specifically for small business owners, not accounting professionals – Xero cloud accounting software.

As a Platinum Xero Partner and experienced user of the software ourselves, we have found that our small business clients really benefit from the programme.

They get real time information on all their key financial figures, save time by using the many automated processes, find it easier to manage and understand their accounts, get more insight and value from their accounts and can easily share information securely with authorised users – and their accountants.

These are strong benefits that allow owners to concentrate on running their business, while making effective decisions based on sound financial information.

If you’re considering how to improve your accounting processes and your financial decisions, we strongly recommend finding out more about Xero. Here’s a brief guide to Xero cloud accounting features and benefits, but if you’d like to discuss it in more detail feel free to get in touch.

What is Xero and cloud accounting?

You’re probably familiar with cloud-based software. It’s available for many popular, important business applications – think what Internet banking, Office 365, SalesForce or Amazon Web Services have done for business.

Cloud software means you don’t have to install or maintain programmes on your own computer systems; you access them through an Internet connection. That means any authorised user can access their programmes and their data from any location and on any device – laptop, desktop computer or smartphone.

When it comes to accounting, it’s so much more convenient to access and check information, update records, carry out transactions like sending invoices or share information with other people wherever you happen to be working.

That’s a big bonus in the post-pandemic period where you and your management team might be working remotely, or if you need to hold virtual meetings with bankers, investors or other stakeholders.

As well as the programme itself, your data is also held securely in the cloud, protected by the highest levels of security. If you ever suffered a disaster at the office like a fire or flood, there’s a serious risk that your data could be lost or inaccessible. No problem, when it’s held in the cloud. All you need is an Internet connection to get your accounting systems up and running again.

The other benefit of cloud-based systems like Xero is that the software company is responsible for backing-up data and maintaining, managing, securing and updating the software, so you don’t need a technician on site to cover that.

Related: Best cloud accounting software for small business

Xero accountancy benefits

Real-time information

One of the biggest benefits of Xero is availability of real-time information. If you’ve struggled trying to figure out if your numbers are right up to date, you’ll know why this is important.

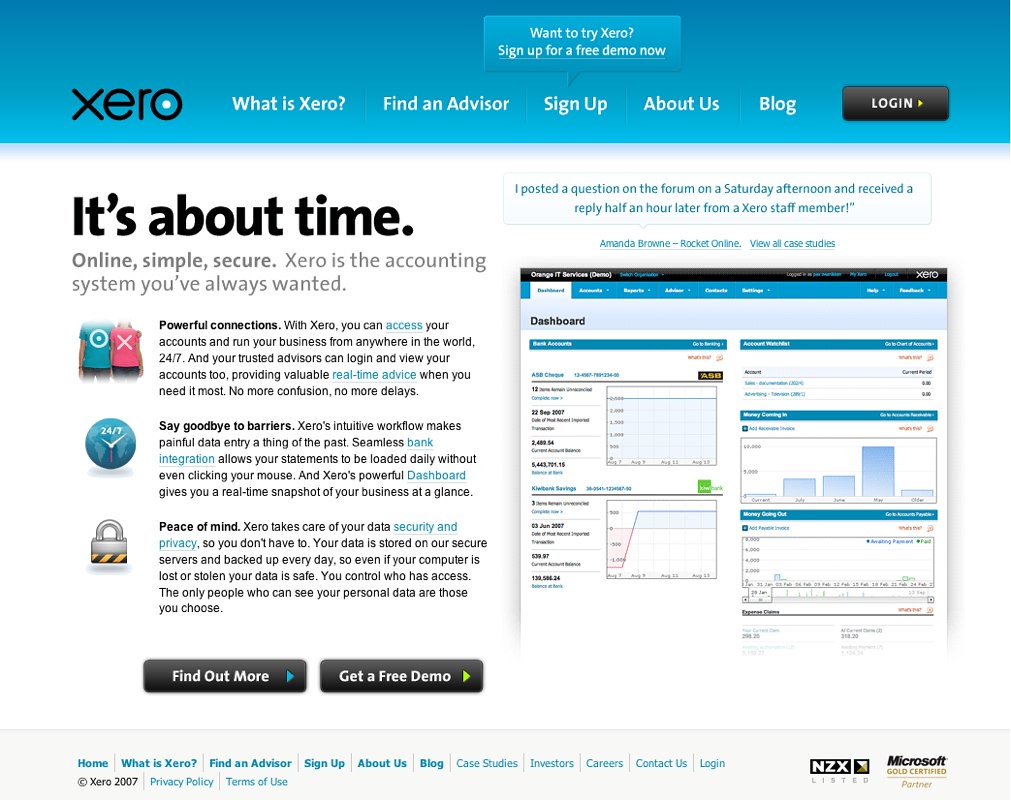

Xero takes into account all the latest transactions and inputs, so any numbers you check are right up to date. There’s a clear, easy-to-use dashboard where you can view the latest figures, but of course our Xero accountants can handle Xero training and migrations.

So, when you’re making important decisions or checking if you need to chase payments or get more funding on board, you can be confident that your calculations are accurate.

Automated functions

Your time is valuable, and you probably wear many other hats apart from your financial responsibilities. With Xero, you can cut down on the time you need to spend on accounting and concentrate on other important aspects of growing and running your business.

Here are just a few examples, some of them using the many add-ons available with Xero.

Bank feeds are automated daily, making bank reconciliations quick and easy. How about uploading receipts, invoices and expenses straight into the system? You can with your smartphone and an add-on known as Receipt Bank.

Xero generates reports automatically, and of course, they include all the latest figures. When you create an invoice and email it from the system, Xero files the information automatically into your accounts. And, when payment is due, the system can use an add-on like Debtor Daddy to issue follow-up notifications. Repeat invoices can be generated automatically too.

Xero can automate payments to suppliers. This is a process which can eat into precious time for business owners; paying bills typically means entering the bill into your accounting software, and then opening up your business banking portal, typing the same information, then authorising it with a battery powered security token. However through it’s Transferwise system, Xero is able to combine these two steps by originating the bank payment directly from Xero as the bill is entered into the system. You can find out more about that here.

Greater insight

As a business owner, the real value you need from your accounting system is not just up-to-date numbers, but in-depth insight into the financial health of your business.

It’s important to get a clear view of cash flow, for example, or the number of customers who are paying late. You want to see how your sales forecasts relate to historical sales, or to identify the key customers who really are important to the growth of your business.

If you’re not familiar with accounting programmes, it can be hard to get that information from your systems, but Xero makes it easier. The developers have designed the software specifically for small businesses.

You can customise reports, for example, to reflect the way you run your business and give other members of the management team information in the form that suits them best.

When you need specific information, either in the form of a summary or a detailed drill-down, Xero can provide either view. And, once you’re familiar with the system, you’ll have a much greater understanding of many important financial aspects of your business.

Learn More: Moving From Sage To XeroSimpler collaboration

The information in your accounting programme isn’t just for your finance team; it’s important to share it easily with other managers, as well as stakeholders outside your business – banks, investors, suppliers and business partners, and your bookkeeper or accountancy company.

With traditional systems, you probably had to rely on emails or memory sticks to share data — methods that were inherently insecure.

Because Xero is cloud based, you can share the information via the Internet by giving authorised users secure access. That makes it easier to discuss performance with your management team, keep stakeholders up to date with your latest financial position and hold reviews or discussions with your accountants when you need advice.

Xero for your business?

We believe that Xero can transform the way you manage and use your accounts, helping you to gain real confidence in your numbers and focus on growth.

If you are interested in adopting Xero, we can help with advice on the best way to implement the software and provide a migration and setup service to transfer data from your existing system.

We can also provide training to help you get the most from Xero, as well as ongoing advice and guidance as you adapt to the Xero way of working. For more information, please contact our friendly Xero accountants on 0207 043 4000 or info@accountsandlegal.co.uk. If you’d prefer to pop in for a chat, we have Xero accountants in Brighton, Manchester and London. You can also get a quick Accountancy quote here.